www tax ny gov enhanced star

Income is defined as federal adjusted gross. The average benefit in Upstate NY is 970.

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

The arrival of tax credits in the midst of an election cycle is not new.

. 2020 New York State or federal income tax forms. The following security code is necessary to prevent unauthorized use of this web site. See Surviving spouse eligibility.

If you are using a screen reading program select listen to have the number announced. As long as you qualify the Enhanced STAR Exemption benefits will be reflected. The total income of all owners and resident spouses or registered domestic partners cannot.

The check goes to homeowners who are eligible for the usual STAR tax break and make less than 250000 a year. The average benefit in Upstate NY is 970. Enter the security code displayed below and then select Continue.

Handy tips for filling out Enhanced star exemption online. 250000 or less for the STAR exemption. The income limit applies to the combined incomes of only the owners and owners spouses who reside at the property.

At the time. You currently receive Basic STAR and would like to apply for Enhanced STAR. Check amounts vary based on your income and the school district where you live.

For jointly owned property only one spouse or sibling must be at least 65 by that date. NYS DEPARTMENT OF TAXATION FINANCE 518-457-2036 OR WWWTAXNYGOVSTAR INSTRUCTION SHEET Filing Deadline. Para asistencia en Espaol llame al 516 571-2020.

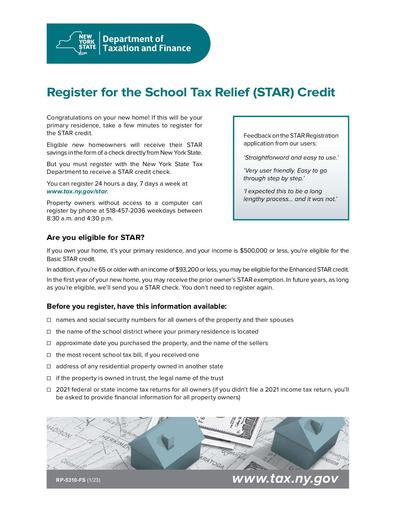

To be eligible for the Enhanced STAR exemption you must meet all of the following conditions. An existing homeowner who is not receiving the STAR exemption or credit. Once the Enhanced STAR Exemption is granted you need not reapply.

The program cost the state 22 billion. WENY The New York State Department of Taxation and Finance is reminding property owners 65-years-old and older who are applying or reapplying to receive the Enhanced STAR exemption. STAR Check Delivery Schedule.

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. Your income must be 92000 or less. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live.

The total amount of school taxes owed prior to the STAR exemption is 4000. However you may be eligible for the Enhanced STAR credit. Eligibility is based on the combined incomes of all the owners and any owners spouse who resides at the property.

If you are registered for the STAR credit the Tax Department will send you a STAR check. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Ny application enhanced star online e-sign them and quickly share them without jumping. The total amount of school taxes owed prior to the STAR exemption is 4000.

A senior who may be eligible for the Enhanced STAR credit. Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply.

Eligible homeowners will see checks in amounts between 132 and 3117. This form is primarily for use by property owners with Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption. 2 days agoThe New York State School Tax Relief Program more commonly known as the STAR Program or New York State Real Property Tax Law 425 is a school tax rebate program offered in New York State aimed at reducing school district property taxes on the primary residences of New York residents.

To be eligible for Basic STAR your income must be 250000 or less. STAR helps lower property taxes for eligible homeowners who live in New York State school districts. Obtain the Enhanced STAR Exemption on their 202223 tax bill by filing the Enhanced STAR Exemption application and Income Verification Worksheet with the Assessor by the Tuesday March 1st deadline.

The Enhanced STAR savings amount for. If the senior wasnt required to file an income tax return the assessor can guide them on how to provide proof of income In 2021 577000 seniors received a total of more than 800 million in savings from the Enhanced STAR property tax exemption. If you qualify for STAR or Enhanced STAR the NYS Tax Department has begun to issue rebate checks and expects most homeowners will receive them before the end of June.

The following security code is necessary to prevent unauthorized use of this web site. Printing and scanning is no longer the best way to manage documents. Register with the NYS Tax Department.

You own your home and it is your primary residence. Andrew Cuomo sent rebate checks just ahead of a Sept. In this example 1000 is the lowest of the three values from Steps 1 2 and 3.

If you are registered for the STAR credit the Tax Department will send you a STAR check. Burden by taking full advantage of the many property tax. STAR resource center.

If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. The STAR exemption program is closed to new applicants. You will be 65 or older by December 31 of the year of exemption.

The Enhanced STAR exemption amount is 74900 and the school tax rate is 21123456 per thousand. If you are interested in filing for the Basic and Enhanced STAR programs please contact the Nassau County Department of Assessment at 516 571-1500. If you are using a screen reading program select listen to have the number announced.

Enter the security code displayed below and then select Continue. New york state enhanced star programte electronic signatures for signing a enhanced star exemption in PDF format. 74900 21123456 1000 158215.

Homeowners who have qualified for the 2022 STAR credit or exemption have an income less than or equal to 250000 for the 2020 income tax year and a school tax liability for the 2022-23 school. 2018 primary against opponent Cynthia Nixon. Ad Download or Email More Fillable Forms Register and Subscribe Now.

A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM. Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. The benefit is estimated to be a 293 tax reduction.

Basic STAR is for homeowners whose total household income is 500000 or less. Even if you exceed this limit you are most likely still eligible for Basic STAR. If No you are NOT ELIGIBLE for the Enhanced STAR exemption off your property tax bill with the Town of Brookhaven.

Exemptions that are offered by Nassau County. If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways. If you are already receiving the STAR credit you do not.

In New York City the STAR Program is a tax exemption for. 500000 or less for the STAR credit. To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year.

Proof of income. MAY BE FILED NOW UP TO BUT NO LATER THAN MARCH 1st 2022.

Application Deadline Nears For Enhanced Star Property Tax Exemption Westside News Inc

Homeowner Tax Rebate Credit Check Lookup

The School Tax Relief Star Program Faq Ny State Senate

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

New Two Star Property Tax Relief Bill By Tedisco Lawler Seeks End To New York S Tax Eternity Ny State Senate

Assessor City Of Johnstown New York

New York Property Owners Getting Rebate Checks Months Early

Tax Collector Tax Assessor Town Of Lewis Ny

Register For The School Tax Relief Star Credit By July 1st Greene Government

Governor Cuomo Signs Fy 2022 Budget And Announces Continuation Of Middle Class Tax Cuts To Help New Yorkers Recover From Economic Hardship During The Covid 19 Pandemic Governor Kathy Hochul

Department Resource Exemptions

Property Tax Exemptions Available To Residents Syosset Advance